The ICO era did not end because crypto fundraising failed. That happened because the model broke under its own weight. And what followed was less a collapse, but more of a reset.

By 2026, crypto fundraising looks very different. Capital flows through private rounds, structured token sales, and regulated infrastructure. Rules and compliance matter severely, while fundraising increasingly looks like a full-fledged process, not a one-off event.

This article breaks down what changed after the ICO boom, what replaced it, and how regulation and compliance now shape crypto fundraising in 2026.

How Crypto Fundraising Changed After the ICO Boom

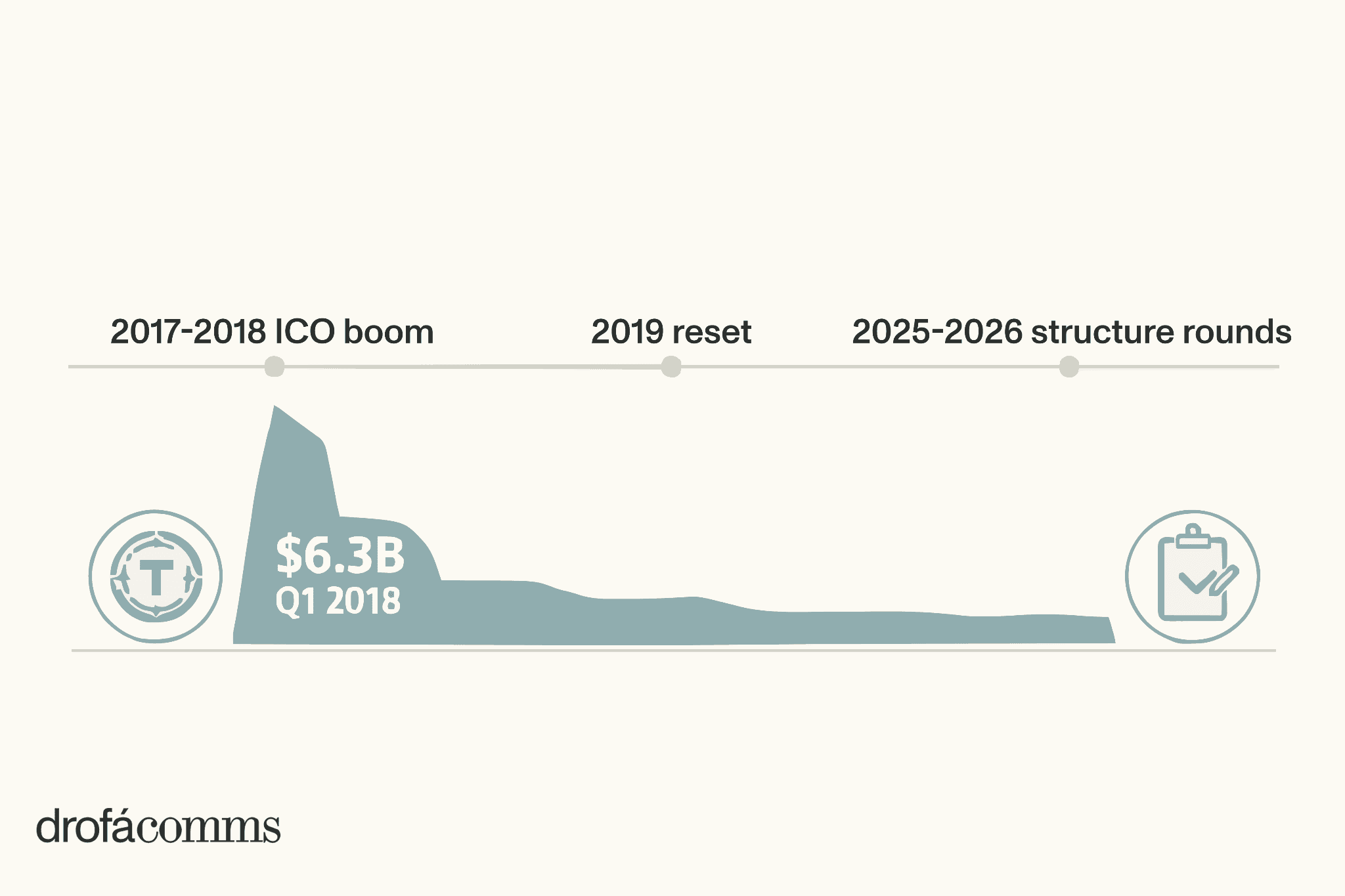

Crypto fundraising changed after the 2017–2018 ICO boom. Back then, ICOs looked like a shortcut to capital. A project could publish a website and a whitepaper, push a strong narrative, and raise funds globally. In Q1 2018 alone, ICO funding reached about $6.3 billion. At the time, due diligence was thin, while expectations were huge.

The reset began after that peak and by early 2019, became obvious. By September 2018, GreySpark Partners report found that nearly half of ICOs launched since early 2017 raised no funds at all. Many others raised money and then went silent, or shipped far less than promised.

However, in 2025 alone, crypto companies raised more than $25 billion even as the ICO label continued to fade. That means that the capital is still here, but the structure has changed.

Today, investors increasingly ask for evidence, timelines, and accountability. Exchanges, payment and banking partners, and regulators raised their standards. As a result, ICOs stopped being the default option and became much closer to a process than to an event.

What Replaced ICOs in 2025–2026

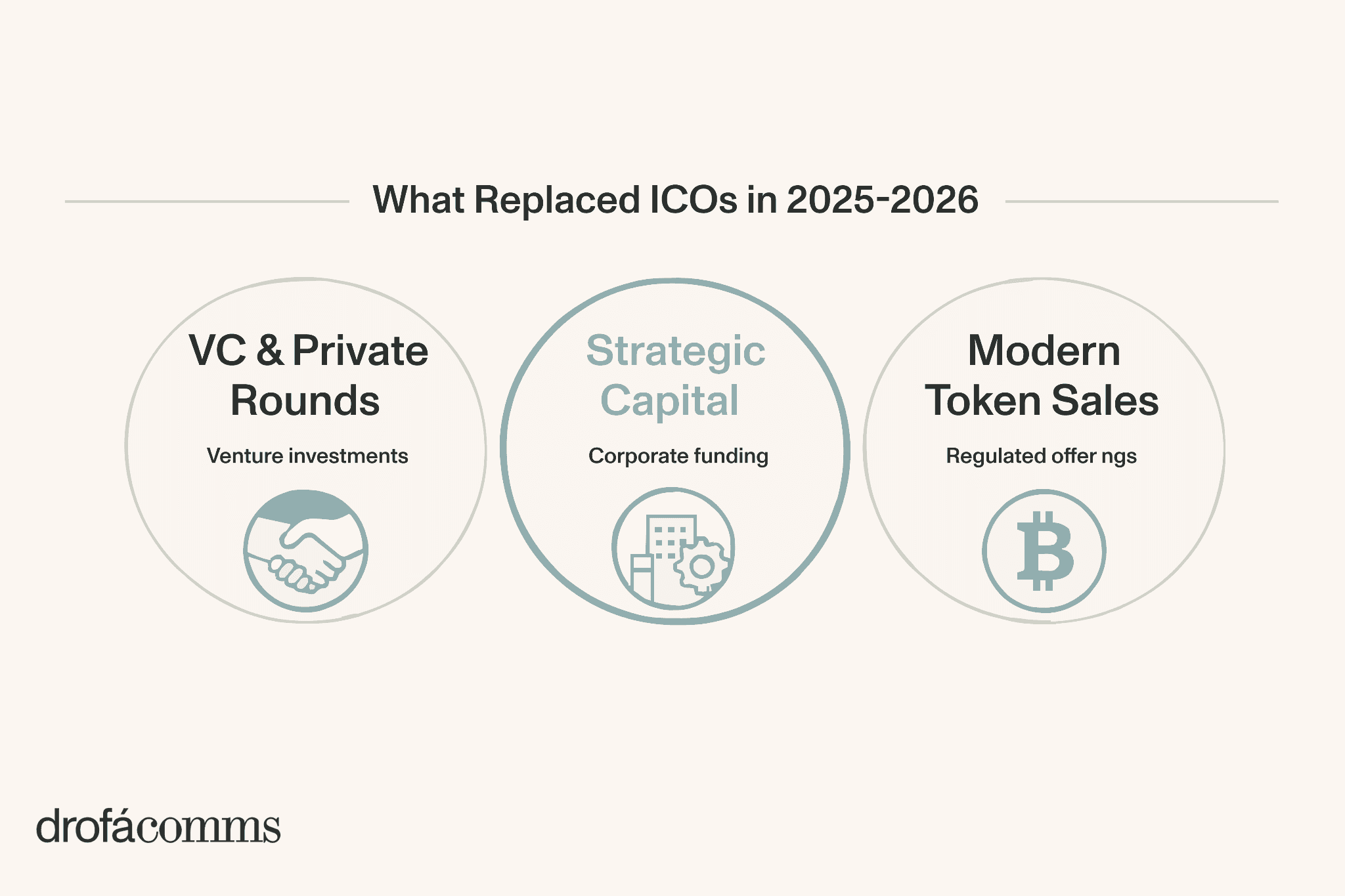

Crypto fundraising stayed large in 2025–2026, but the format shifted. The biggest rounds moved capital into fewer, larger, and more structured deals. In 2025, the top 10 fundraising rounds alone accounted for more than $10 billion, which means that the market changed shape.

Here are the main channels that now dominate:

Venture capital (VC) and private rounds

Private markets became the baseline route for many teams. Galaxy Research estimates crypto and blockchain venture capital in Q3 2025 at about $4.59 billion across 414 deals. Still, this channel comes with heavier requirements such as corporate structure, governance, reporting discipline, and legal clarity. By contrast, it creates better alignment on timelines and delivery.

Strategic capital and corporate participation

Large 2025 rounds show continued interest in infrastructure themes such as custody, stablecoins, tokenisation, and trading venues. Strategic money comes with stricter checks. Teams get more questions about risk, safety controls, and how stable the business is.

Token sales in a modern form

Public token sales still exist, but they are more split by region and more dependent on rules. Many include strict country and user filters, tighter marketing rules, and stronger listing and liquidity planning. Some are run via platforms, while others are tied to ecosystem launches. The common shift is a stronger link between access, disclosure, and user protection.

So, the best way to frame this for 2026 is that fundraising now needs staged design. Teams plan the sequence: structure, disclosure, partner readiness, market access, then liquidity.

Regulation: MiCA in the EU and the FCA Direction in the UK

In 2026, regulation plays a crucial role. It shapes what can be offered, who can access it, how assets are safeguarded, and what can be said publicly about risk and returns.

In Europe, MiCA moved into execution. TRM Labs describes a shift from policy to implementation, including the start of the CASP regime and the parallel enforcement environment around the Travel Rule. This turns licensing strategy into a core decision. Moreover, it forces teams to connect product design to rule constraints like marketing, disclosures, distribution, and custody models.

In the UK, the FCA has been building a clearer framework for key infrastructure segments. In CP25/14, the FCA consults on rules and guidance for stablecoin issuance and cryptoasset custody/safeguarding. That means stablecoins and custody are being treated as financial infrastructure, with expectations on resilience, safeguarding, and governance.

That way, at the product level, this indicates that:

Whitepapers and public materials carry higher scrutiny. They operate as evidence of what was promised and how risks were framed.

Custody and safeguarding become a separate layer of readiness. Banks, payment providers, and institutional clients tend to evaluate this before a deal.

Distribution design matters. Jurisdiction gating, user eligibility, and marketing restrictions need to be built into token sale planning.

What Compliance Looks Like in 2026

The ICO cycle left a lasting lesson. Fraud and weak consumer protection destroy trust faster than any market drawdown. That is why compliance and illicit finance risk are near the center of policy discussion in 2026.

TRM Labs points to broad regulatory tightening across jurisdictions, with continued emphasis on AML and sanctions compliance, including the UK. This focus follows the growth of stablecoins, cross-border flows, and faster on-chain settlement. As volumes rise, monitoring and controls become non-optional.

What tends to slow teams down in partner onboarding, investor diligence, and exchange reviews usually falls into three buckets.

Identity and funds checks: stronger KYC/KYB, plus clearer source-of-funds expectations for larger flows.

Transaction monitoring: KYT, risk scoring of addresses, and tracing exposure to high-risk activity.

Operational safeguards: sanctions screening, clearer listing, and market-integrity rules. The same is true for custody controls such as segregation of assets, access management, audit logs, and incident response.

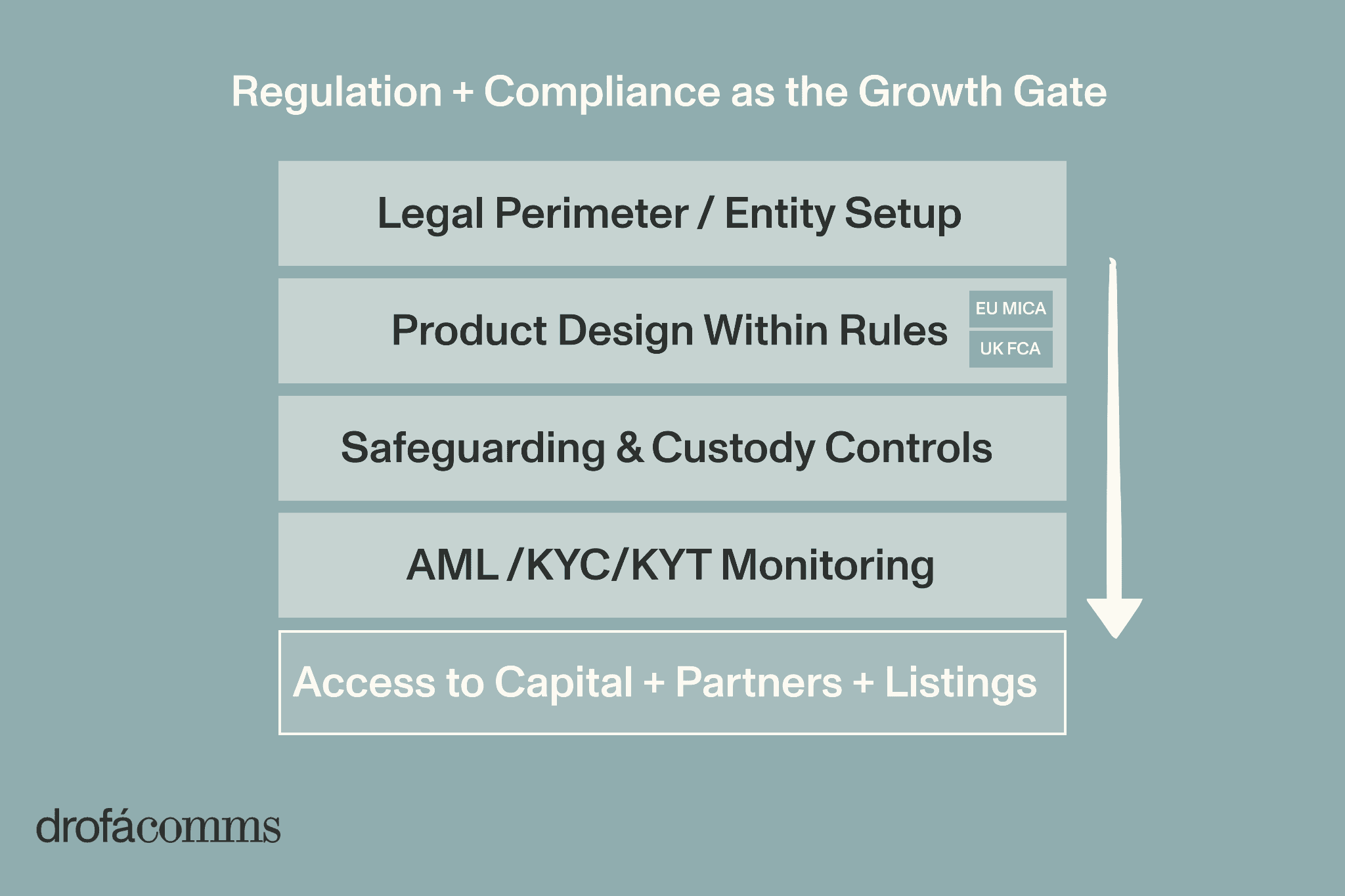

As a result, in 2026, compliance increasingly acts as a growth lever. It shapes access to capital, bank and payments relationships, enterprise customers, and market entry options.

Conclusion: Takeaway for Projects and Investors in 2026

A useful conclusion for a 2026 update is that capital remains available, and it is concentrated in channels that reward maturity. Teams that treat structure, controls, and disclosure as first-order priorities move faster through diligence and partnerships.

For projects, this means they should define the legal perimeter, design the product within regulatory constraints, build safeguarding and monitoring, then choose the fundraising format that fits the model. This reduces late-stage rewrites and reputational risk.

Investors need to treat governance and compliance quality as strong predictors of survivability. They show whether a team can scale distribution, keep partners, and operate under tightening rules. Additionally, they reveal whether the project can withstand scrutiny when market conditions shift.

That is why, at Drofa Comms, we believe the ICO story, even though muted, still matters. It functions as a reference point for how fundraising breaks when control systems are thin.

Schedule your free consultation

A review of your current communications activities

General recommendations on what to focus on

PR Consultant's vision on how PR could help your business growth

other materials

All articles