The fraud market continues to surge, and not surprisingly, its maturation is tightly connected to the growth of the cryptocurrency and AI market, where every participant wants to get sky-high interest rates. A shortcut to prosperity becomes a common dream, and fraudsters know how to sell that.

That’s why everything came together in recent years: trends, paired with hype from the media and influencers, heating up the market. People want to be a part of the current movements and don’t think about reality. Because of this negligence, more than $17B was stolen only in crypto scams and fraud in 2025, which is a massive 1400% year-over-year growth.

In this article, we take a closer look at the scamming techniques and explain how to recognise fraud before it’s too late.

From Meme Coins to AI Scams

It is interesting that fraud always goes hand in hand with the market. Scammers closely monitor financial markets and replicate them precisely. For example, the latest wave of fraud reflects the increased attention towards artificial intelligence.

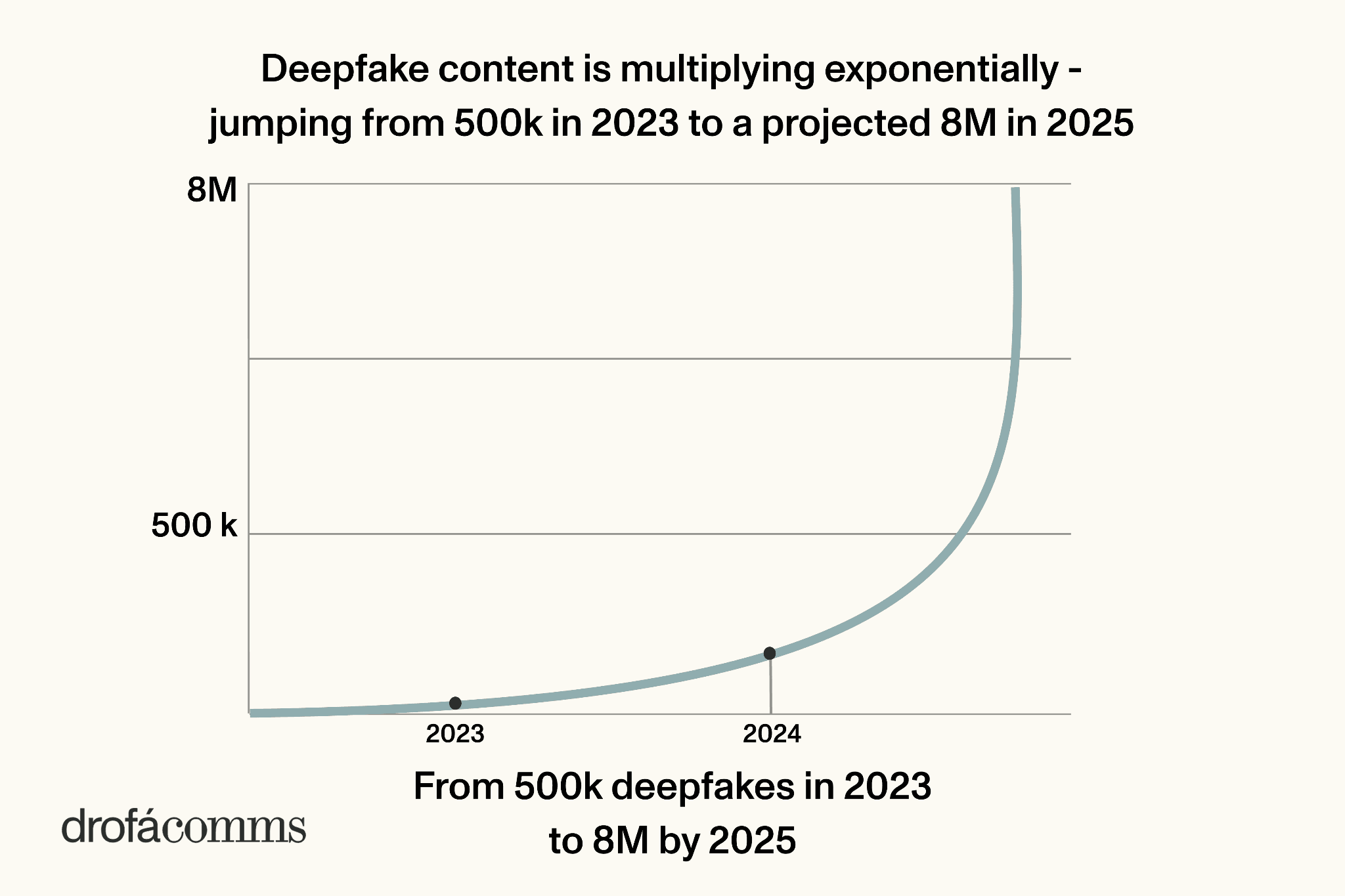

According to different analyses, AI-related investment scams saw a 68% increase over the previous year, with con artists promising “AI-powered trading” and “fully automated profit bots.” Many of these projects use deepfake videos of tech CEOs and financial experts to boost credibility.

The most interesting part of this fraud type is that people actively believe it, with a higher success rate than usual scams. Numbers show that AI-enabled tricks were highly “fortunate,” showing 4.5 times higher profitability than any other deceit. And after a very prosperous year in 2025, the AI fraud is set to explode even more in 2026.

Another technique that uses AI is building artificial copies of the financial sites, especially in the crypto field, to create professional-looking phishing sites in minutes. Using a simple prompt, these platforms can clone an existing site’s design, branding, and even customer service features in seconds.

Examples of fraudulent sites include fake Coinbase logins, Microsoft Office 365 portals, DHL delivery pages, and even localised tech support scams created with AI website builders. As you read this article, more than 580 new malicious websites are appearing around the world.

Old Fraud, but in a New Package

The core of a fraudulent scheme is always the same: “bring money to get big profits.” People are always chasing easy income, and scammers have been taking advantage of that for ages.

For example, as social media develops, Europol's 2025 Internet Organised Crime Threat Assessment (IOCTA) shows that social media investment scams are rapidly increasing. Criminals use the same old tactic but wrapped in digital technology — with the help of AI, they use personalised ads and deepfakes to exploit victims across digital platforms.

When it comes to less common scamming methods, there are government grant scams. Government grant fraudsters try to get your money by guaranteeing you a grant for expenses such as studying in college or house repair.

Scammers request information about your current account, saying that they will deposit the grant money there. In reality, this type of governmental aid is rarely assigned to private individuals. They are usually sent to state and local authorities, universities, and other organisations.

With the digitalisation, these scamming methods have only become more widespread and easier for thieves. What used to require phone calls and paperwork is now scaled through automated emails, social media ads, and AI-generated messages that look indistinguishable from real communication.

Red Flags That Never Change

The danger lies in the fact that scammers keep coming up with new, original schemes for stealing funds, and people don’t realise that they are dealing with con artists, so they trust them. To protect yourself from potential fraud, it’s better to stay on alert and see what are the other tricks that scammers use:

Fake ads and impersonation on social media

Beyond dangerous personal contacts and promises of astronomical profits, one of the most common red flags is advertising on social media that impersonates exchanges, brokers, or banks. These ads often promise easy money or exclusive opportunities. For example, scammers pretending to be Binance used AI-generated content to offer users a “Binance card,” even though the real exchange had no connection to the offer at all.

Fake ads and impersonation on social media

Beyond dangerous personal contacts and promises of astronomical profits, one of the most common red flags is advertising on social media that impersonates exchanges, brokers, or banks. These ads often promise easy money or exclusive opportunities. For example, scammers pretending to be Binance used AI-generated content to offer users a “Binance card,” even though the real exchange had no connection to the offer at all.

Lack of transparency around the project

Another important warning sign is the way a company or project presents itself. You should pay close attention to whether clear information about the team and the project is publicly available. It also matters what reputable media outlets say about the project, in what context it is mentioned, and how the community discusses it on social networks.

Dubious claims about famous connections or the team

You also have to research the team thoroughly. If the project name-drops famous politicians, musicians, or blockchain gurus, it’s worth questioning whether these connections are real. In many cases, such claims are used solely to create an illusion of credibility. If the project looks too ambitious for its actual scale or resources, it may well be a scam.

Manipulative language

Excessively complex terminology and phrasing, vague wordings seeking to attract funds, and phrases like “bring a friend to get more interest” also point to a Ponzi or pyramid scheme. Legitimate projects focus on clear explanations and sustainable value, not pressure tactics or referral-based profit promises.

Common Fraud Indicators Checklist

All in all, no matter how innovative the scam looks, several signs always repeat, so check our potential fraud checklist:

Unrealistic promises of high yields that seem too good to be true

Urgent calls to action — “Limited-time opportunity,” “invite a friend.”

Excessively technical or vague explanations of how profits are generated.

No transparent information about the team, partners, or legal registration.

Heavy name-dropping of celebrities or experts to create fake credibility.

If you ticked at least 2-3 points, you are probably dealing with a scam, so beware.

Conclusion

In 2026, fraud is no longer defined as an easy deception by phone or email. It has evolved from obvious tactics to sophisticated techniques that align with the market trends. As crypto and AI continue to attract attention and capital, scammers will inevitably follow, adapting old schemes to new technologies.

That’s why everyone has to be very attentive. Your awareness is becoming the strongest defence against con artists. When investors know more about how modern scams operate and the red flags that never change, they significantly reduce the risk of becoming a victim.

Schedule your free consultation

A review of your current communications activities

General recommendations on what to focus on

PR Consultant's vision on how PR could help your business growth

other materials

All articles