In 2026, Web3 no longer feels like a “brave new world.” A few years ago, many projects could win attention with vision, community energy, and project launches. That approach still exists, but it does not carry a product on its own anymore. The market now puts pressure on execution: rules you must follow, value users can feel, and responsibility that shows up when something goes wrong.

Actually, this shift did not happen for one reason. It came from a set of circumstances that arrived at the same time: tougher regulation in major markets, more careful partners, and a user base that has seen enough cycles to ask better questions. In that environment, Web3 stops being a “movement” and starts being judged like infrastructure.

That is the lens for this article we want to use. So, let’s unpack what changed, why it matters now, and what teams should do if they want to grow in 2026.

What Web3 Means in 2026

In 2026, Web3 is a group of working systems people use to move value, run services, and coordinate activity. Most Web3 products sit in three main lanes, and each lane has its own success rules.

Regulation

Web3 sits inside stronger legal frameworks, especially for stablecoins, exchanges, custody, and token issuance.

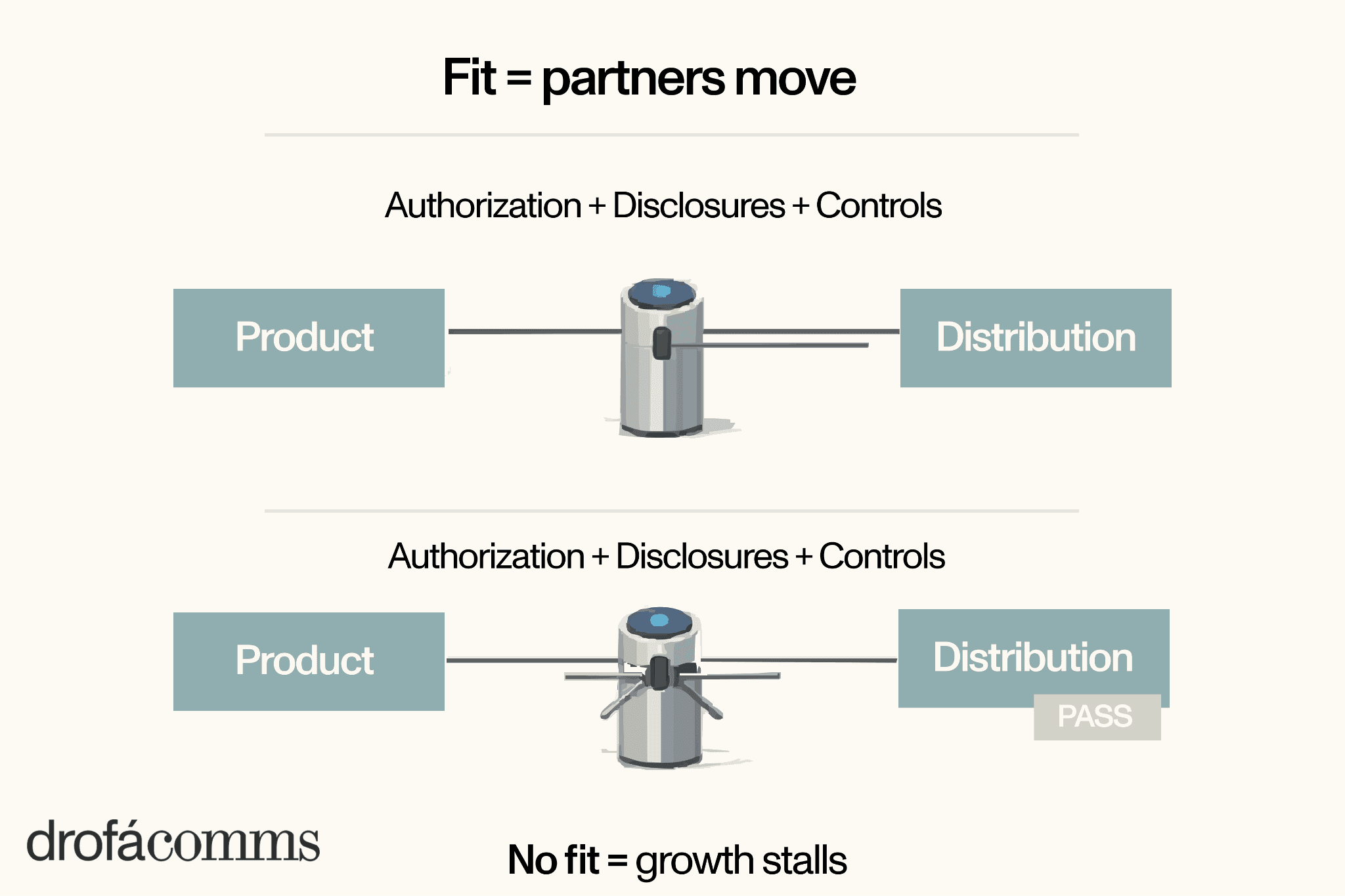

That means Web3 teams cannot treat rules as “later” work. Regulation now decides where you can operate, which partners will work with you, and what you can promise users. If your legal setup, disclosures, and controls are weak, growth stalls — even if the product is good.

Tokenisation

Real assets are turned into tokens and used for settlement, collateral, and yield in digital markets.

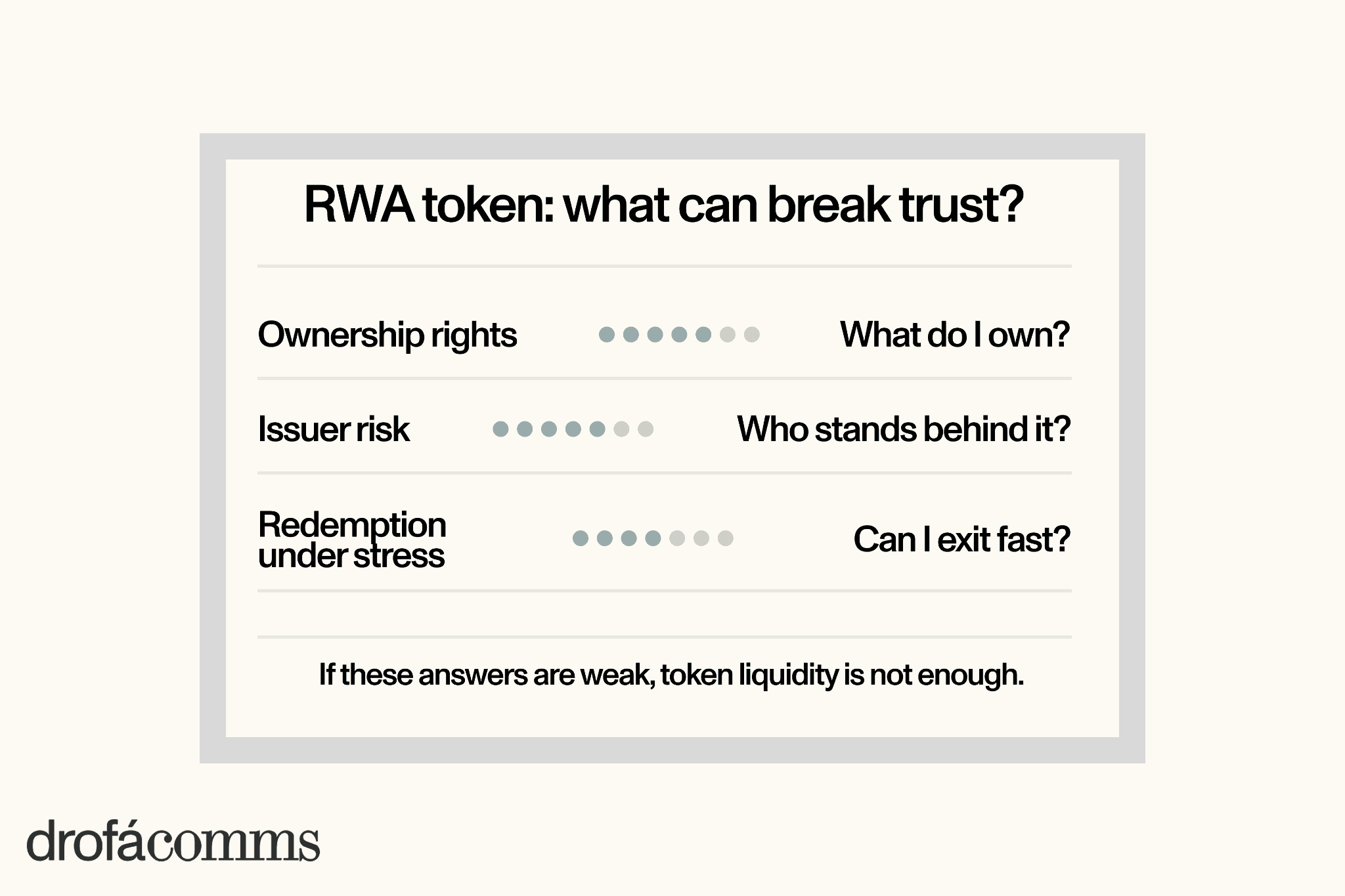

This matters because it connects Web3 to assets and cashflows that businesses already understand. It also makes on-chain finance less dependent on token hype, since returns can come from the underlying asset. At the same time, it raises questions about ownership rights, issuer risk, and redemption under stress.

Decentralised Physical Infrastructure Networks (DePIN)

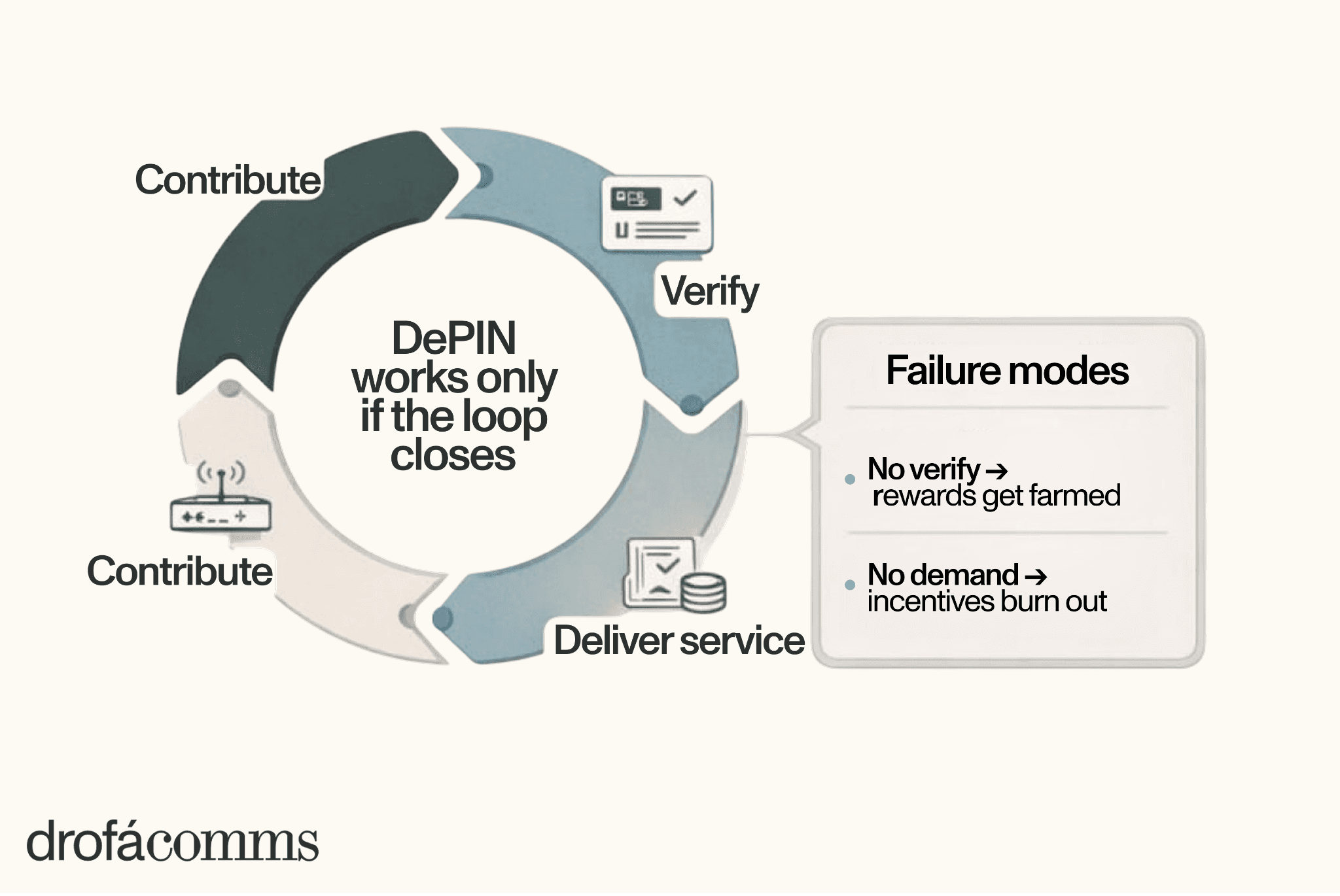

Tokens are used to coordinate physical networks, where people contribute hardware, data, coverage, or compute. That way, DePIN links tokens to real work and real service delivery. If the network can verify the contribution and attract paying demand, it can grow without constant speculation.

Together, these lanes show what Web3 has become in 2026: infrastructure-like products that must follow rules, deliver real economic value, and hold up in real conditions.

Regulation: MiCA in Europe, the GENIUS Act in the U.S.

In Europe, MiCA sets one EU-wide framework for crypto-assets. It covers areas such as transparency and disclosure, authorisation and supervision, and consumer protection. This means many Web3 business models in the EU now depend on regulatory status, paperwork quality, and ongoing oversight.

Stablecoins sit under heavier attention in Europe. MiCA treats key stablecoin types as asset-referenced tokens (ARTs) and e-money tokens (EMTs), and it ties them to authorisation requirements and supervisory standards. For teams that turn reserves, redemption, governance, and operational resilience into daily operating work, since partners will ask for evidence.

In the U.S., the GENIUS Act builds a federal framework for “payment stablecoins,” defined as digital assets that an issuer must redeem for a fixed value. It pushes the market toward more formal issuer duties and oversight, which again changes how stablecoin teams build distribution and partnerships.

Across both regions, it is now evident that a compliance fit becomes a growth gate. It shapes where you can operate, which banks and platforms will integrate you, and what you can say publicly about safety, backing, and user outcomes.

Tokenisation in 2026: RWAs as the Fastest-Growing Use Case

Tokenisation is growing fast in 2026 because it starts with assets the business already trusts. Teams take real-world assets such as U.S. Treasuries, fund units, or real estate, and represent them as tokens that can be held and transferred on-chain. This makes it easier to use these assets inside digital markets for settlement, collateral, and yield.

The growth is also visible in market tracking. RWA.xyz shows “distributed asset value” in the low tens of billions and a much larger “represented asset value,” with holder counts in the hundreds of thousands. Even if metrics vary by method, tokenised assets are no longer a niche concept.

For many institutions, tokenised Treasuries can support cash management and collateral use across platforms, while tokenised funds can make access and transfer simpler.

Still, tokenisation does not remove old risks. IOSCO flags that some structures can create uncertainty about rights to the underlying asset, even when an investor holds the token. So, even if the token trades smoothly, the holder may still face limits or disputes when trying to claim, redeem, or enforce rights to the real asset behind it.

DePIN in 2026: When Tokens Build Real Infrastructure

DePIN stands for Decentralised Physical Infrastructure Networks. The idea is that tokens are used to reward people for building and running physical networks. This can include wireless coverage, sensors and data networks, energy resources, and shared computing.

DePIN matters in 2026 because it shows a token model tied to real work. Instead of paying contributors through a traditional company structure, the network uses incentives to attract participants and expand coverage faster. In the best cases, tokens help coordinate thousands of small contributors who would not join without a direct reward.

But DePIN only works when the network can prove what happened in the real world. If a system cannot verify devices, measure service, and stop fake activity, rewards get farmed and costs grow quickly. That is why verification design is not a “nice to have” in DePIN. It is the foundation.

How to Understand Web3 in 2026

Here is Drofa Comms’ checklist for teams that want durable growth in 2026.

1. Build with regulation in scope

If Europe matters to you, treat MiCA requirements as part of product planning, documentation, and user flows. If you touch stablecoins in the U.S., map issuer duties and redemption expectations early under GENIUS-style frameworks.

2. Make the value path easy to explain

A strong Web3 product in 2026 has a simple “value path”: who pays, who earns, why the token is needed, and what happens in stress.

3. Put responsibility into operations

Have an incident plan, decision rights, escalation paths, and user communications ready. Partners judge this before users do, and users judge it when something breaks.

Our CEO, Valentina Drofa, often writes about why teams need communication and response planning in place before things go wrong. In one of her expert opinions, she puts it in plain language: “Today, companies are judged constantly by clients, investors and even their own teams. Silence isn’t safety, and inconsistent messaging can be worse than bad news.”

4. For tokenisation, lock down structure before scale

Define asset backing, custody/servicing roles, redemption mechanics, and reporting cadence. If these are weak, the distribution stalls.

5. For DePIN, tie rewards to verified work

Rewards should follow measurable service delivery, with anti-gaming design from day one. Then build real buyers, rather than contributors only.

Conclusion

In 2026, Web3 is shaped by regulation, tokenisation use cases, and DePIN models that connect tokens to real-world activity.

Our take on this topic is to treat Web3 as infrastructure. That means building systems that can pass partner reviews, handle stress moments, and explain value without hype. When the product and the operating model meet that standard, communications become easier, and growth becomes more systematic in 2026.

Schedule your free consultation

A review of your current communications activities

General recommendations on what to focus on

PR Consultant's vision on how PR could help your business growth

other materials

All articles