In 2021–2022, NFTs felt unstoppable. There were headline sales, celebrity collections, and trading volumes that made “mass adoption” feel close. Back then, events like Binance Blockchain Week in Dubai reflected the mood: founders, exchanges, and builders framed NFTs as a core crypto layer.

By 2026, the market is sharper and far less sentimental. Awareness is high, while belief is weaker. A large share of consumers now cite NFTs as “the bubble that popped,” and fewer people now treat them as an investment category.

At Drofa Comms, we see 2026 as a filter for the NFT market. It rewards NFTs that behave like products and infrastructure, with clear user value, reliable distribution, and compliance-ready execution. It discourages projects that depend on novelty, vague “community” promises, or resale-first narratives.

Below is what the NFT market looks like in 2026.

2026 Reality: Awareness Rose, Trust Stayed Weak

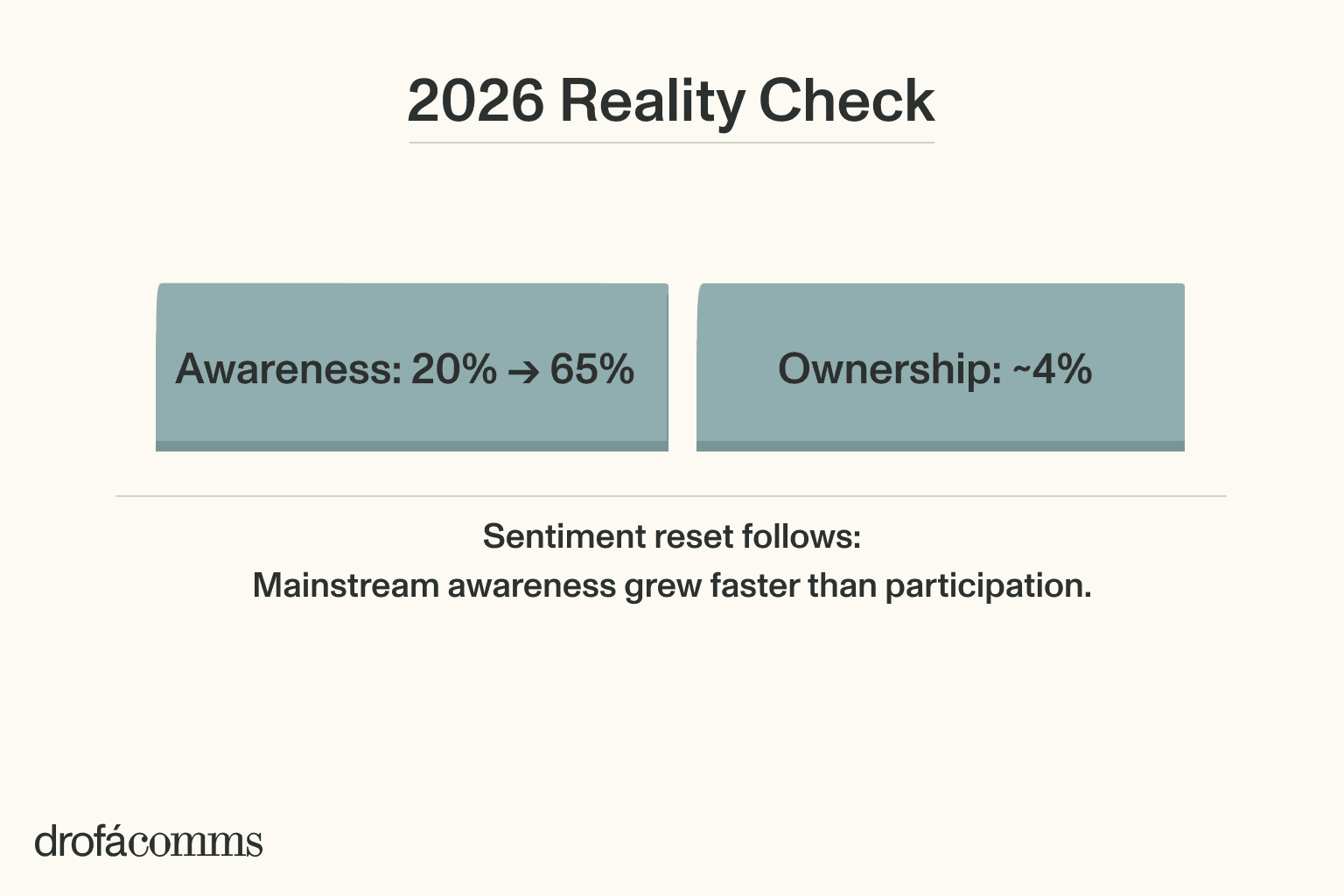

The NFT market entered 2026 with a wider audience and a smaller tolerance for stories that rely on price alone. Recent awareness research shows how widely the term reached the mainstream. It climbed to 65% by late 2025, up from 20% in 2021. Ownership, though, did not grow at the same pace. About 4% of U.S. adults have ever owned an NFT, and growth slowed through 2024.

So, it’s becoming non-negotiable that a market discipline is finally doing its job. A couple of years ago, hype created distribution for free. Now, distribution has a price tag: trust, usability, legal clarity, and support when something breaks.

This is also consistent with the broader crypto direction heading into 2026. Today, mainstream narratives lean toward institutional adoption and infrastructure building, with less focus on retail speculation.

What this changes for the NFT market:

“Community” no longer works as a strategy on its own. It turns into a retention layer that must sit on top of real utility.

Brands need to treat NFTs as a regulated digital product surface. That means disclosure, consumer protection, and fraud risk become part of the creative brief.

Any pitch that starts with resale value triggers immediate scepticism; access, identity, ticketing, and in-product ownership read as more defensible value drivers.

Where NFTs Still Work in 2026

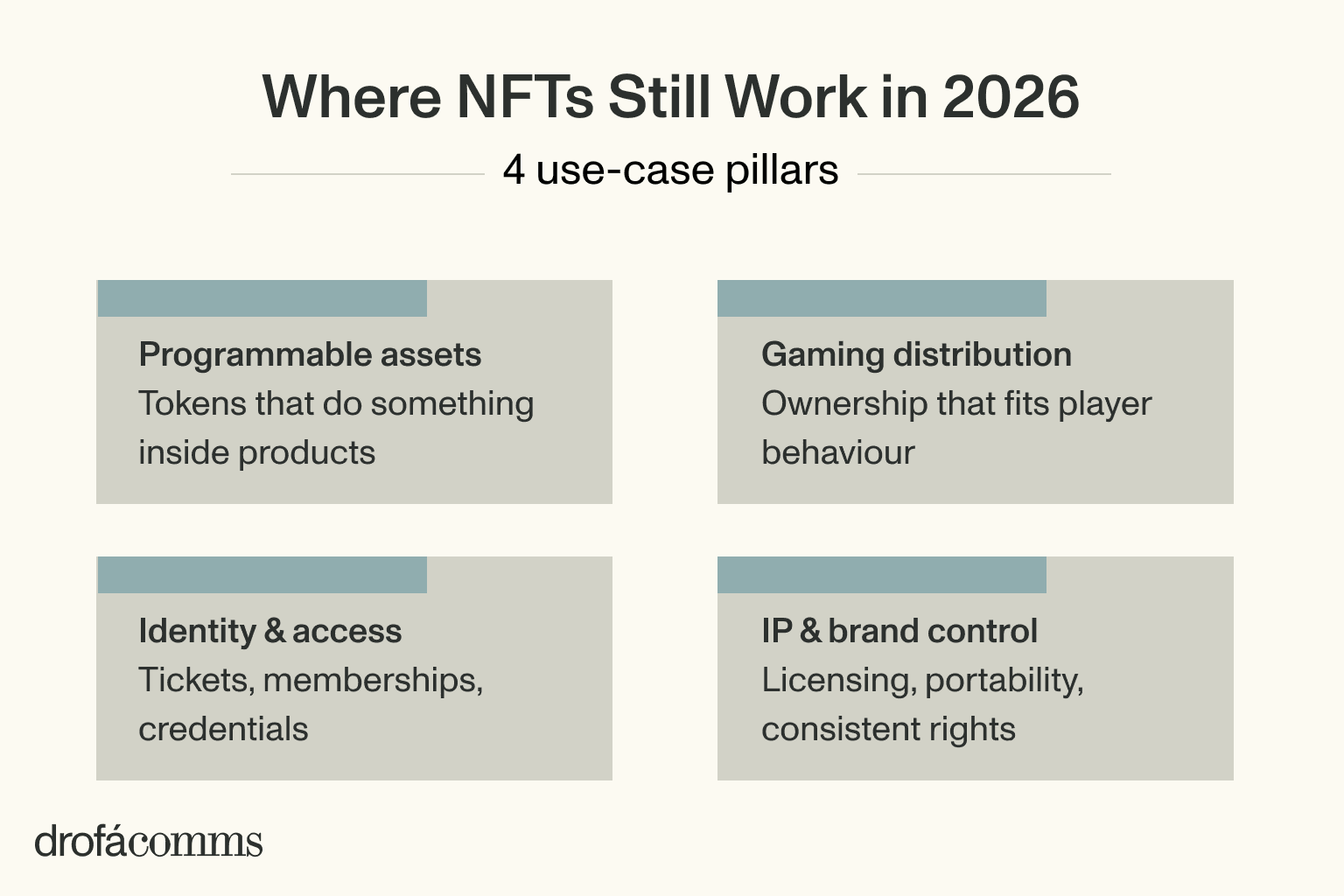

The NFT projects that still work in 2026 share one trait — they behave like functional digital property. The market moved past static profile-picture collecting as the default narrative. What keeps compounding is NFTs used as programmable objects inside products, such as ownership, access, identity, inventory, and rights management.

NFTs as programmable assets

Some analysts frame it this way: NFTs are increasingly treated as programmable objects rather than fixed images. That includes tokenised positions, evolving media formats, and identity-linked assets that perform a function.

In 2026, this framing matters because it turns NFTs into a product primitive. Utility becomes the anchor, and secondary-market price becomes optional.

Gaming as the distribution engine

Gaming still offers the most viable path to scale, and the logic is operational.

In 2026, games adopt what improves retention and monetisation metrics. This includes portable inventory, user-owned items, progression-based access, and integrated marketplaces that match how players behave.

Gaming also drives on-chain activity as standards mature. This is consistent with where adoption tends to happen first — inside products people already use every day.

Identity and access users understand

As already mentioned, awareness about the NFT industry is high, but trust is fragile, and few consumers treat NFTs as investments.

That makes “drops” a harder sell, especially for mainstream brands. Access-based NFTs, such as tickets, memberships, credentials, and verification, carry lower narrative risk because they sell a function. In 2026, this builds utility that survives even when the market is bored.

Intellectual property strategy and brand control

A significant share of NFT strategy looks like an IP (intellectual property) strategy. More consolidation and acquisition-style thinking around collections as cultural assets is expected by industry researchers.

This year, it reads as a distribution and control play, that is, transparent licensing, consistent brand narrative, and assets that can be shared between games, events, and media. All is without improvising legal frameworks each time. “Community” still matters, but it becomes the retention layer on top of rights, utility, and repeatable storytelling.

Conclusion: NFTs in 2026 Are an Execution Test

These days, NFTs have turned into a competence test. The market has stopped “buying the idea.” It rewards implementation: what rights the token represents, how those rights are enforced, and how fraud is prevented. That is why the loudest NFT projects weakened while the more silent, utility-shaped deployments kept moving.

We believe the next wave will look less like another collectibles boom. It is simply off the agenda. So it will more resemble NFTs dissolving into products people already use, where the token is the backend for access, ownership, credentials, or distribution.

In that framing, the winners will be the teams that can deliver an end-to-end user cycle, secure it, support it, and explain it in plain language to regulators, partners, and consumers.

Schedule your free consultation

A review of your current communications activities

General recommendations on what to focus on

PR Consultant's vision on how PR could help your business growth

other materials

All articles