Payments in 2026 have turned into a test of trust. Customers still care about price and convenience, yet the real battle lies deeper. They increasingly ask whether a bank can verify identity fast, stop fraud without blocking good users, and move money in seconds at any hour.

This matters because the threat model changed. In the EU/EEA, reported payment fraud reached €4.2 billion in 2024, and the largest value losses came from credit transfers and card payments. Fraud is also shifting toward scams that push users to approve transfers themselves, which reduces the value of “classic” security controls on their own.

So this article breaks down what banks need to rebuild in 2026 to stay competitive and preserve customer loyalty.

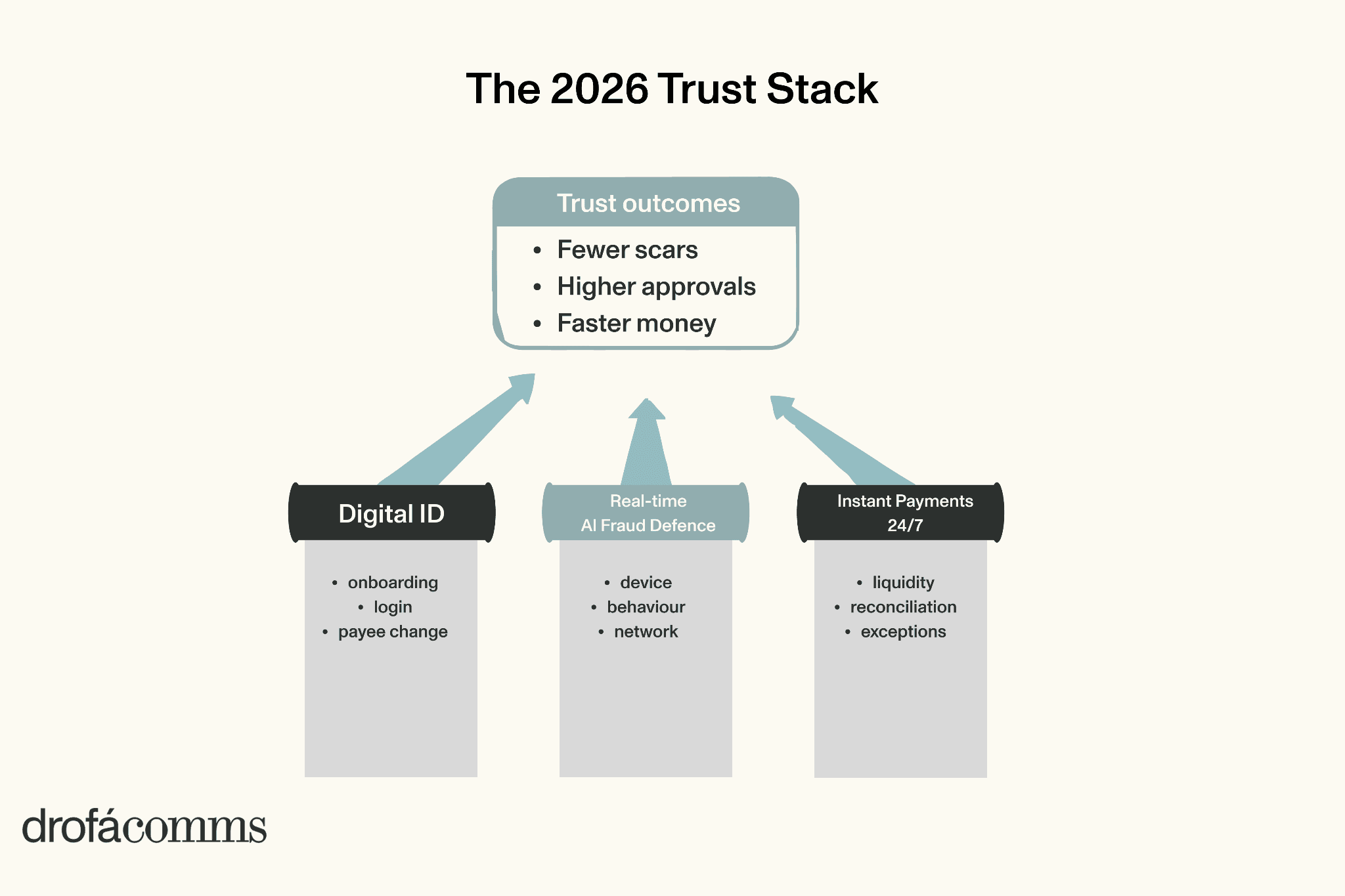

Three Pillars of the 2026 Payment Stack

In 2026, payment digitalisation is built on three pillars. First, digital identity, where onboarding and authentication become part of the payment experience. Second, AI-driven risk and fraud controls that make decisions in real time. Third, instant payment rails that move money 24/7 and force banks to modernize operations around speed.

Digital identity inside the payment flow

Digital identity is no longer a standalone compliance step. It now sits inside the payment journey because many fraud paths start at onboarding or account access and end with a fast transfer. Because of that, banks are pushing checks deeper into key moments: sign-up, login, card provisioning, payee changes, and high-risk payments.

Regulation is moving in the same direction. The EU Digital Identity (EUDI) programme and wallet rollouts raise expectations for banks and large service providers. Strong identity starts to look like shared infrastructure, with banks integrating it into their own UX.

AI-driven fraud defence in real time

AI in payments cuts both ways. Banks use it to spot anomalies faster. Attackers, in turn, use it to scale social engineering, deepfakes, synthetic identities, and account-takeover tactics.

Industry reporting in 2025 already flagged rising pressure from AI-enabled identity and impersonation fraud. For banks, this shifts fraud defence from manual queues to real-time decisions at the moment of initiation.

In 2026, strong anti-fraud teams run continuous scoring across:

device signals;

behaviour patterns;

payee history;

network links and message context.

The best systems learn quickly from confirmed outcomes because scam patterns mutate fast. Moreover, better fraud scoring changes product economics. Higher approval rates for legitimate payments improve conversion and reduce support costs.

Instant payments as the default expectation

Speed is now part of “quality.” In the eurozone, EU rules and implementation milestones have been pushing the market toward instant euro payments, available 24/7. For many banks, the transfer is the easy part. Yet, the operational layer is harder: reconciliation, liquidity management, exception handling, refunds, and support workflows that used to run in batches.

Verification of payee is a visible example. Regulators want fewer scams driven by recipient confusion. So, verification becomes mandatory under the Instant Payments Regulation, with different timelines for euro-area and non-euro-area member states. That means banks need to treat recipient confirmation as core UX, instead of a compliance add-on.

How to Design Payments to Resist Scams and Fraud

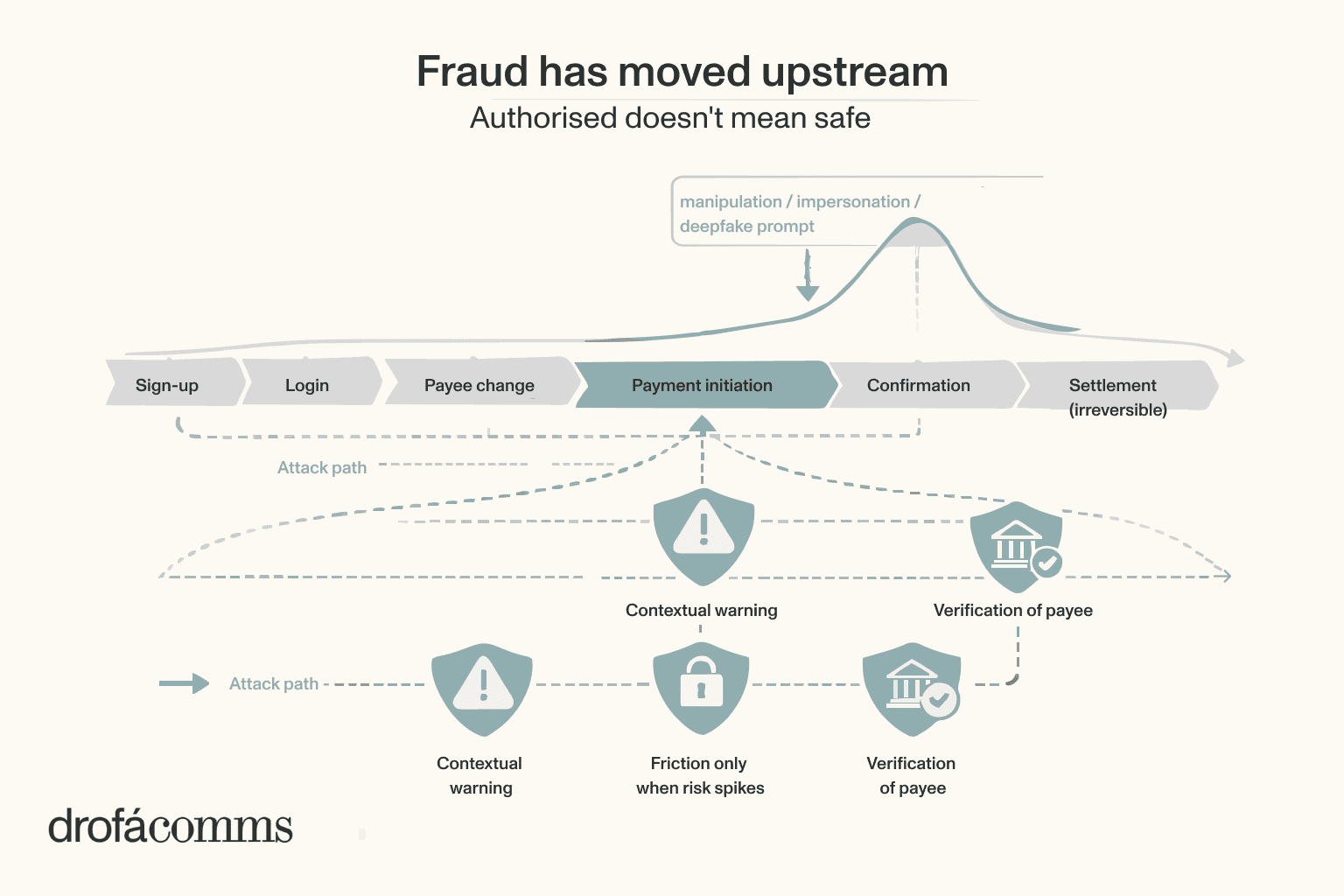

The most uncomfortable fraud trend is the one where the user is “authenticated” and still loses money.

EBA/ECB reporting shows that payer manipulation accounts for more than half of the total value of fraudulent credit transfers. It’s obvious that authentication alone no longer protects users. A payment can be authorised and still produce a fraudulent outcome when the user is misled.

This forces a product responses that work in practice:

Warnings need to be contextual and specific.

Controls need to be placed at the point of irreversible loss.

Customer education should keep up with adversaries.

The bank that blocks scams while keeping payments smooth wins. Scam resistance becomes a product advantage because it protects customers without slowing down everyday transactions.

The Role of Blockchain in 2026 Payments

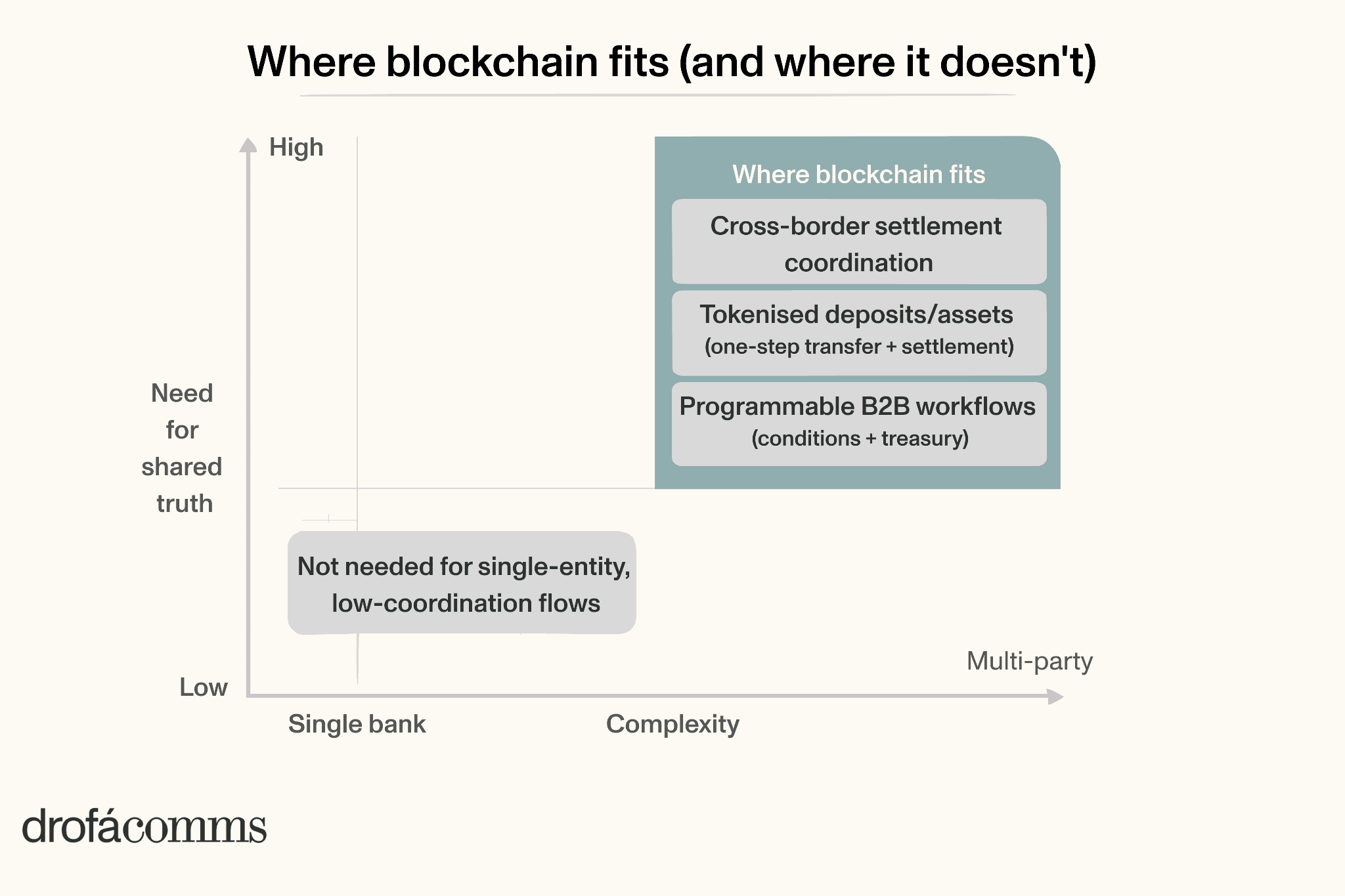

In 2026, blockchain in payments works best as a shared settlement and coordination infrastructure. It helps when multiple parties need a common source of truth, programmable rules, or faster reconciliation across entities.

This framing matches the way major industry research describes the market. McKinsey’s Global Payments Report treats “digital money” and related rails as a structural force reshaping how value moves and how payment economics evolve. So the competitive pressure is real, but it is not evenly distributed across use cases.

Where blockchain typically makes sense in 2026 payments is the following scenarios:

Settlement coordination across entities (especially cross-border and multi-institution flows).

Tokenised deposits and tokenised assets, where transfer and settlement can be closer to “one step.”

Programmable B2B workflows, where payment is linked to conditions (delivery events, invoice approvals, collateral rules, treasury automation).

As a result, the strongest deployments reduce operational friction. That includes less manual work, shorter settlement cycles, cleaner audit trails, and simpler coordination between regulated parties.

Conclusion

In 2026, payment digitalisation has clashed with a severe reality: “payments” are becoming the visible edge of a bank’s trust architecture. Scams scale, AI accelerates both defence and attack, and instant rails remove the time buffer. In this environment, the old model of security as a separate layer stops working.

Trust has to be engineered into the flow, measured like a product metric, and backed by operations that can keep pace 24/7.

At Drofa Comms, we see many teams still communicate features, while the market buys outcomes: safer approvals, fewer irreversible errors, and faster money movement. The banks that align product, risk, operations, and narrative around those outcomes will be easier to trust and easier to choose.

Schedule your free consultation

A review of your current communications activities

General recommendations on what to focus on

PR Consultant's vision on how PR could help your business growth

other materials

All articles