Southeast Asia has become one of the most important battlegrounds for global fintech, crypto, and digital finance companies. What used to be seen as an “emerging market” is now a core growth engine for the global financial system, driven by mobile-first consumers, a massive SME economy, and one of the highest rates of digital financial adoption in the world.

By 2025, Southeast Asia’s digital economy had exceeded $300 billion in annual transaction value, according to Google, Temasek and Bain. Financial services — including payments, lending, crypto trading, and digital wallets — is one of the fastest-growing segments inside that economy. More than 70% of adults in Indonesia, Vietnam, and the Philippines now use digital payment platforms, while countries like Vietnam and the Philippines consistently rank in the global top 10 for crypto adoption.

Yet despite the size of the opportunity, many Western fintech companies fail in the region. The reason is usually market misreading.

Why Southeast Asia Is a Critical Growth Market for Fintech and Crypto

Sooner or later, any successful fintech or digital finance company reaches the same point: domestic growth slows, competition increases, and international expansion becomes inevitable. Southeast Asia is often the first region executives look toward — and for good reason.

The region has one of the world’s fastest-growing digital economies. Countries such as Indonesia, Vietnam, the Philippines, Thailand, and Singapore are seeing explosive adoption of mobile payments, digital wallets, crypto trading platforms, and embedded finance. In many markets, consumers skipped traditional banking infrastructure entirely and moved straight into app-based finance.

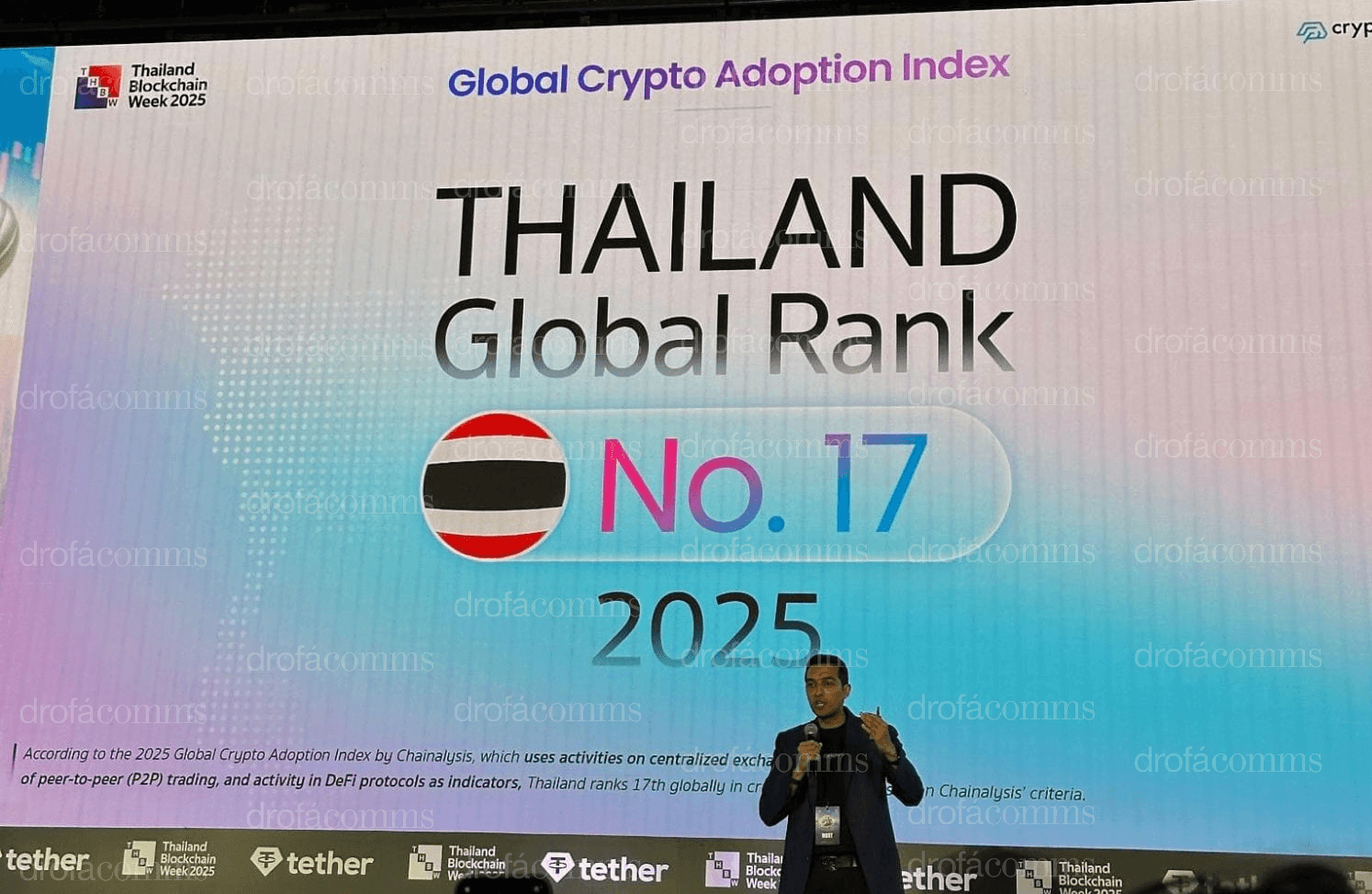

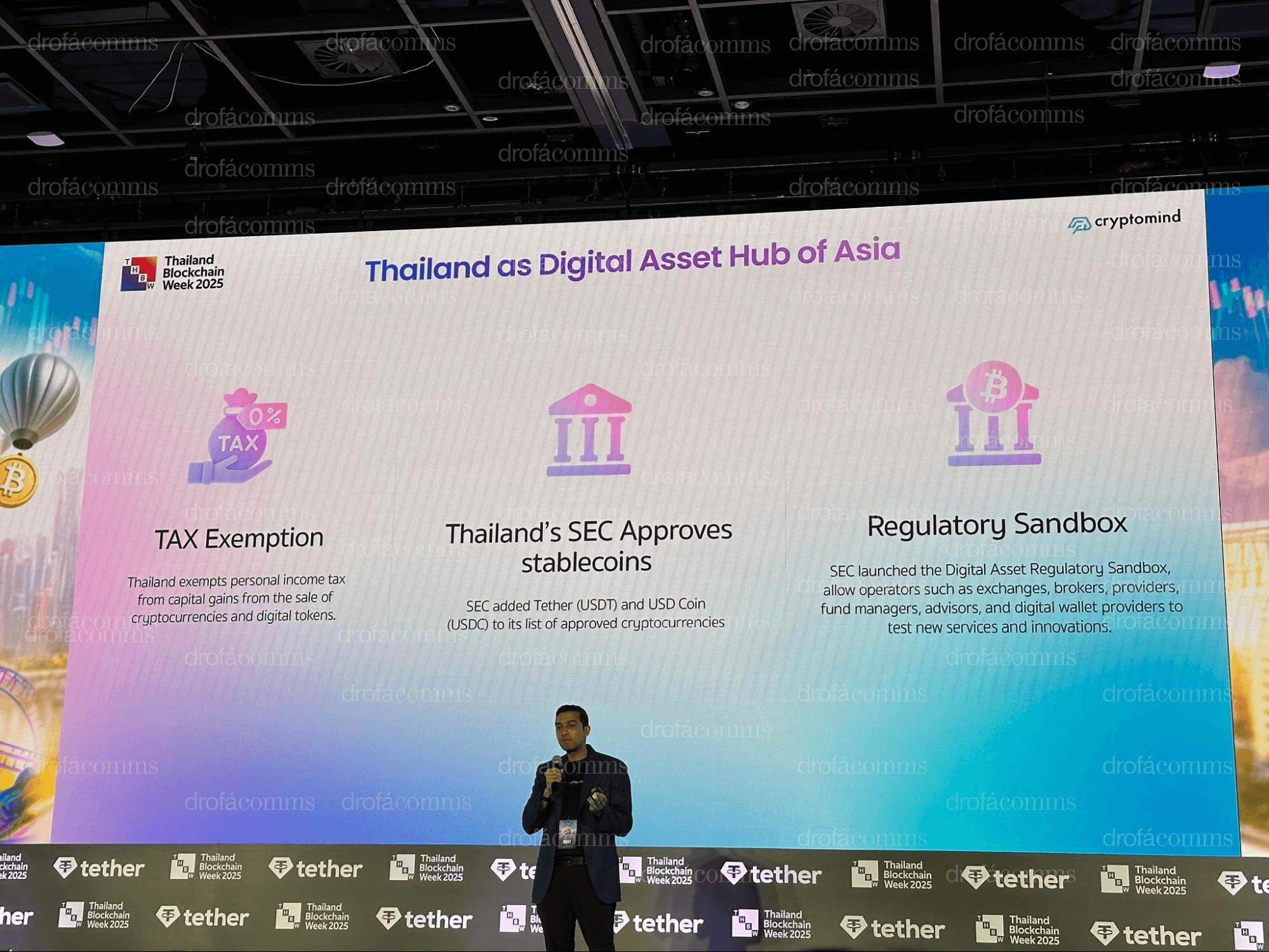

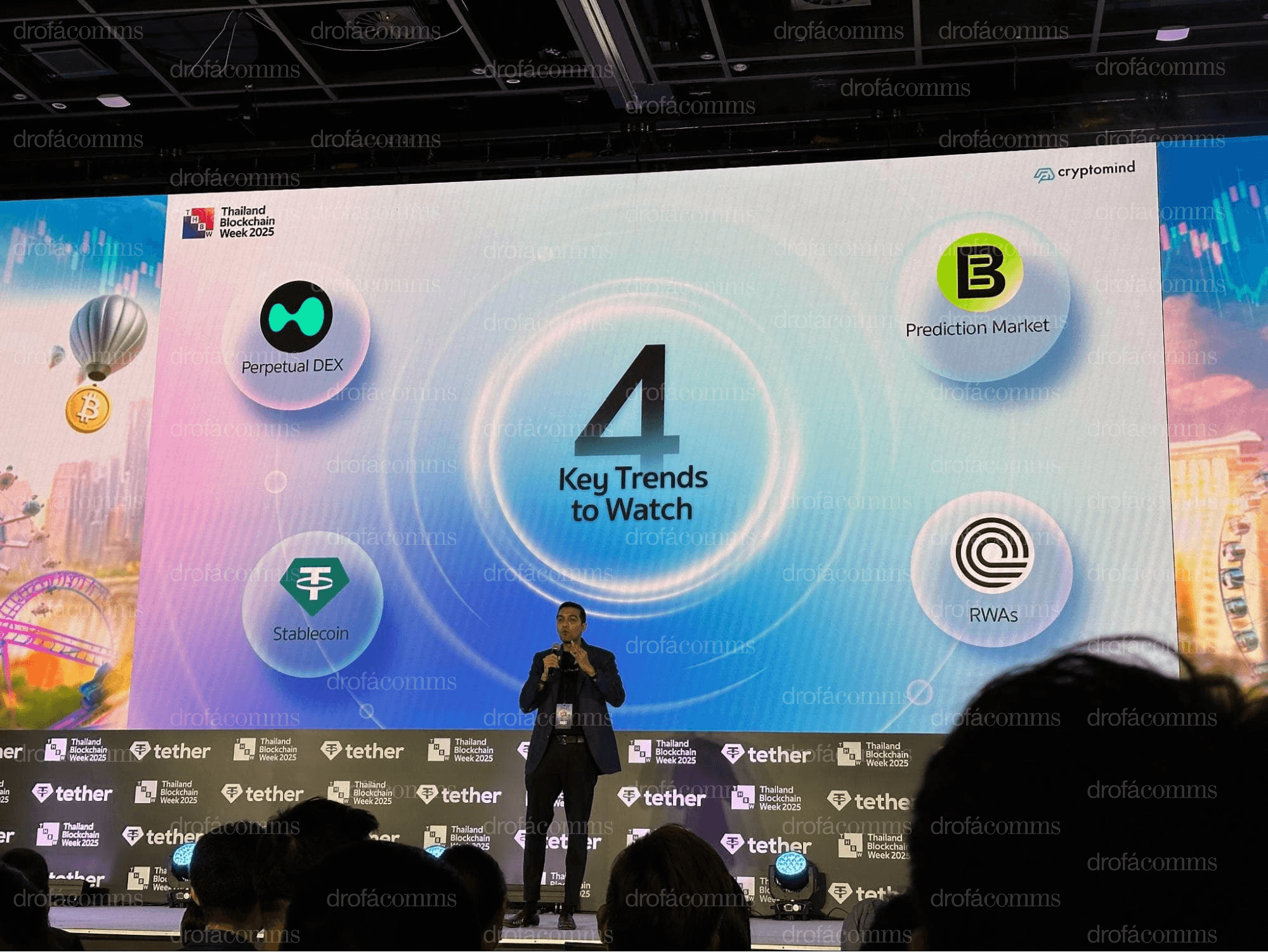

Speaking about Thailand, in November 2025, our Head of Content, Niya Ibrahimova, attended Thailand Blockchain Week, where she gathered valuable insights into the local market. They include:

The country’s digital-asset market value reached THB 1.045 trillion in September 2025, marking a 3.99% month-on-month increase.

Thailand’s digital-asset transaction volume grew by around 65% year-on-year, driven by broader retail use and stablecoin adoption.

Crypto ownership remains one of the highest in the region, with 17.5% of the population engaged in digital assets.

Why Southeast Asia Is Not One Market

Southeast Asia consists of more than 700 million people across 11 countries, each with its own regulatory system, banking structure, political environment, and cultural norms. It is a network of deeply different countries, languages, legal systems, religions, and consumer behaviours.

Singapore is a highly regulated financial hub. Indonesia is a population giant with fragmented banking. Vietnam is rapidly digitising but tightly controlled. Thailand has high crypto adoption but cautious regulators.

So, entering Indonesia is not like entering Vietnam. Thailand is not Singapore. And assuming that one regional strategy fits all is one of the fastest ways to burn capital. A single regional strategy almost never works.

This is why companies must be honest about their internal capacity before expanding. High-quality market entry requires:

Regulatory analysis;

Local consumer behaviour research;

Payment and distribution mapping:

Competitor benchmarking;

Partnership scouting.

In many cases, it is cheaper and safer to work with international research firms that specialise in Asia than to try to build this knowledge internally and get it wrong. Underestimating the cost and complexity of entry is one of the most common mistakes foreign fintech firms make.

How to Build Brand Visibility in Asian Fintech Markets

Unlike in Europe or North America, brand recognition plays an outsized role in Asia. Many Asian partners are cautious about working with foreign companies that have no visible reputation in the region. Trust is built socially before it is built contractually.

That is why trade shows, fintech expos, and regional conferences matter so much. These events are not just about lead generation; they are about signalling legitimacy. When a European or US fintech brand appears consistently at major Asian industry gatherings, it sends a message: this company is serious about the region.

The audiences at these events typically include private entrepreneurs, fintech founders, payment providers, institutional traders, and distribution partners. While private meetings and negotiations remain essential, large-scale industry events act as accelerators for visibility, reputation, and informal deal flow.

In Asia, business is rarely done in isolation. Mutual recommendations matter. If your company has successfully worked with a partner in one Asian country, that credibility travels across borders.

The Real Commercial Drivers of Southeast Asian Fintech Growth

Several forces make Southeast Asia uniquely attractive to fintech and crypto companies:

First, the region has one of the world’s largest unbanked and underbanked populations. Hundreds of millions of consumers and small businesses operate with limited access to credit, formal savings, or cross-border payments. Digital wallets and fintech apps fill this gap faster than traditional banks ever could.

Second, Southeast Asia is a global remittance hub. Migrant workers send around $98.12 billion in 2025 into the region — and this number is projected to reach $145.62 billion by 2030. This creates enormous demand for low-cost, fast settlement — a space where stablecoins and blockchain-based payment rails are increasingly competitive.

Third, the SME sector dominates most economies in the region. Small and mid-sized businesses need lending, invoicing, FX, and payroll tools that traditional banks struggle to provide. Embedded finance and fintech platforms are stepping in.

This combination — mobile-first consumers, weak legacy banking, and massive cross-border money flows — creates ideal conditions for fintech scale.

How to Choose the Right Entry Point

Not all Southeast Asian markets should be approached at once. Smart fintech expansion starts small.

Fintech companies should start in markets where:

Regulation is clearer;

Distribution partners are accessible;

Customer behaviour is easier to test.

Singapore often serves as a launchpad because of its regulatory clarity, financial infrastructure, and international credibility. From there, companies may move into Indonesia, Vietnam, or Thailand once they understand the region better.

“Your first market in a new region defines how regulators, banks, and partners will see you everywhere else. A weak or rushed entry creates reputational drag that is very difficult to undo later,” said Alina Sysoeva, Head of PR at Drofa Comms.

Having a dedicated international development lead from the very beginning is critical. Market entry is not a side project. It involves regulatory compliance, product adaptation, payment integration, marketing localisation, and partnership negotiation — all at once.

And now, there is another layer that can no longer be ignored: inclusion.

Why Gender Inclusion Is Now a Fintech Growth Strategy

Walk into almost any fintech or crypto conference and one thing becomes obvious: women are still heavily underrepresented. Despite the sector’s claim to innovation, it continues to draw from a surprisingly narrow talent pool.

Across global financial markets, women control or influence a vast portion of household and entrepreneurial spending. Yet financial products are still overwhelmingly designed by, and for, male users. According to World Economic Forum data, 80% of women-owned businesses with credit needs are underserved or unserved by traditional financial systems.

That gap represents more than US$700 billion in unrealised opportunity.

In fintech, where innovation depends on understanding real user needs, excluding half the population is a direct threat to growth.

What This Means for Companies Entering Southeast Asia

For fintech and crypto firms expanding into Southeast Asia, inclusion is no longer optional. Local partners, regulators, and customers increasingly expect companies to reflect the societies they serve.

Building diverse leadership teams, supporting female founders, and partnering with inclusive communities improves brand trust, regulatory credibility, and long-term customer loyalty.

Southeast Asia is still writing the rules of its fintech ecosystem. Companies that enter now have a rare chance to shape those rules — not just in terms of technology, but in terms of who gets to build it.

Those who understand that inclusion is not charity but strategy will be the ones who scale sustainably across the region.

Conclusion

Southeast Asia is no longer a secondary growth market for fintech and crypto companies — it is one of the key regions where the future of financial services is being shaped. Rapid digital adoption, a massive SME economy, and strong cross-border money flows create powerful growth opportunities, but only for firms that are willing to invest in real market understanding.

Success in the region depends on more than technology or capital. It requires regulatory depth, local partnerships, cultural fluency, and products designed around how people actually use financial services. Companies that get this right will not only scale faster, but will help define the next generation of financial infrastructure in one of the world’s most dynamic markets.

Schedule your free consultation

A review of your current communications activities

General recommendations on what to focus on

PR Consultant's vision on how PR could help your business growth

other materials

All articles